DuitNow Request

A service that allows payees to send digital payment request to collect funds from a payer. DuitNow Request service is available via eWallet, mobile and internet banking.

With DuitNow Request, payees may send payment request 24/7 at an instance, through the payer's mobile, MyKad/passport, army/police, Business Registration (BRN) or bank account number(s). DuitNow Request allows payment to be collected from Current Account Savings Account (CASA), Line of Credit (LOC) Account and eWallet.

Who Can Use DuitNow Request

Individuals

Send payment requests to your family and friends through their mobile or MyKad number

Businesses

Send payment requests for invoices or bills to customers' mobile, MyKad or BRN

Government

Send payment requests for tax or assessments to individuals' MyKad or Business Registration number

How To DuitNow Request

Available Participants

Transaction Limit

| Individuals | Businesses |

|---|---|

| Up to RM50,000 per day | Up to RM10,000,000 per day |

The transaction limit is subject to the conditions of each participating bank or eWallet. Please contact them for more details.

Frequently Asked Questions

Consumers

With DuitNow Request, you can request for money instantly on a 24/7 basis through mobile numbers, NRIC numbers, Business Registration numbers or Bank Account numbers. You can request for funds instantly anytime, anywhere.

Login to your Internet/Mobile Banking or e-Wallet and make a DuitNow Request to one of the payer's IDs below:

- Mobile number

- NRIC number

- Passport number

- Business registration number (only SSM-registered businesses)

- Bank Account number

DuitNow Request is currently available at Internet/Mobile Banking as well as e-Wallet application in Malaysia.

No registration is required to make a DuitNow Request.

Yes. You can reject the request.

You may send up to a total of 20 DuitNow Requests and pending Payer's action at any given time. After sending the 20th DuitNow Request, you will need someone to act on your pending DuitNow Request if you want to send a new one.

DuitNow Request transfers occur immediately, and payees will usually receive money in their bank account instantly upon the payer's approval.

Yes. You will receive a notification.

It is free for consumers.

All types of banking accounts can be used to pay except fixed deposit accounts. This includes all types of conventional and/ or Islamic savings accounts, current accounts, investment accounts, virtual internet accounts, and e-Wallet accounts.

Daily transaction limit is up to RM50,000 for consumer. The limit is subject to each individual Bank's or e-Wallet risk assessment or appetite.

Businesses

Login to your Corporate Banking channel and make a DuitNow Request to one of the payer's IDs below:

- Mobile number

- NRIC number

- Passport number

- Business registration number (only SSM-registered businesses)

- Bank Account number

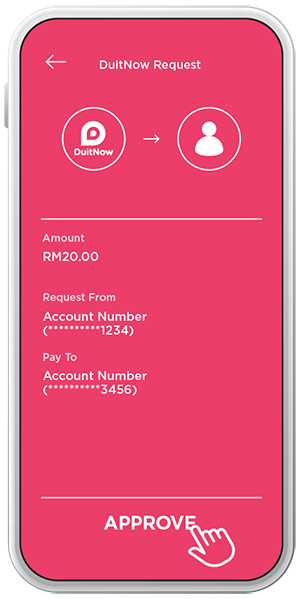

Payer will receive a DuitNow Request notification to approve it from their Internet/Mobile Banking or e-Wallet. Once the DuitNow Request has been reviewed and approved by the payer, funds will be credited to Payee's bank account immediately.

Daily transaction limit is up to RM10,000,000 per transaction.

The limit is subject to each individual Bank's or e-Wallet risk assessment or appetite.

Acquirers may offer different fees structure. For more information, contact your acquirer.

Yes.*

*Subject to terms and conditions of your acquirer.

The expiry date of the payment request will be displayed to both you and the Payer.

DuitNow Request offers clean reconciliation, reducing issues arising from incorrect payment data from customers. Businesses may also bunder a one-off consent registration request to collect funds from customers on recurring basis together with DuitNow Request.

Please contact your bank/payment provider for further details regarding enablement of DuitNow Request.

The speed of the transaction appearing on financial reports/statements may vary depending on your bank.