Cross-Border Fund Transfer

In collaboration with PayNow Singapore, Malaysians are now able to send and receive money from Singapore instantly through DuitNow via your online banking or eWallet* mobile app.

Transfer funds to any PayNow-registered mobile number in Singapore from

the selected mobile banking and eWallet apps.

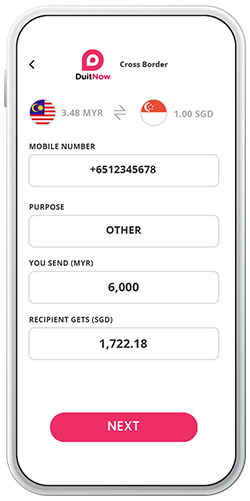

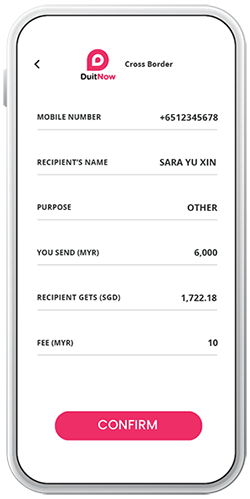

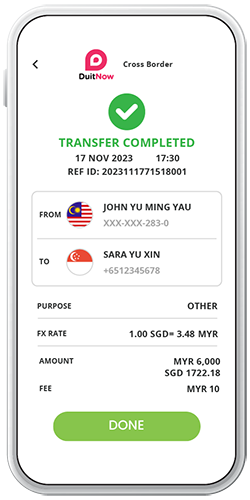

How To Cross-Border Fund Transfer

Effortlessly send and receive funds across borders with DuitNow

Where To Cross-Border Fund Transfer

In Malaysia

In Singapore

*Please note that users may only send and receive cross-border fund transfers from the available participants in Malaysia and Singapore that are stated above.

For more information, please contact your respective banks or eWallets.

Frequently Asked Questions

With Cross Border Fund Transfer, you can conveniently transfer money to your friends or families in Singapore using their PayNow registered Mobile number or VPA instantly on 24/7 basis anywhere.

Registration is not required to send money via Cross-Border Fund Transfer.

In order to receive money via Cross-Border Fund Transfer, a one-time registration is needed to link your ID with your bank account or e-money account.

Cross Border Fund Transfer is available at the Internet and Mobile Banking channels of participating banks in Malaysia, as well as participating e-money mobile apps.

It’s immediate and recipients will receive money in their bank account or e-money account instantly.

You must first register for DuitNow by linking your Mobile number with your bank account or e-money account at participating banks and payment providers.

Once you have registered, Cross-Border payers can direct payments to you using your DuitNow registered Mobile number (DuitNow ID).

Consumers may transfer up to RM 3,000 per day at participating banks or e-Money payment providers.

The exchange rate will be quoted by your bank or eWallet and displayed to you before you confirm the transfer.

The amount deducted from your bank or eWallet account will be in MYR.