DuitNow QR

An interoperable QR standard that allows Malaysians to make payments and receive funds from any participating Bank and eWallet with just one QR code.

How To Pay With DuitNow QR

How to transfer with DuitNow QR

Where to DuitNow QR

Available Banks and eWallets

Frequently Asked Questions

DuitNow QR is Malaysia's National QR Standard established by PayNet under the Bank Negara Malaysia's Interoperable Credit Transfer Framework (ICTF).

DuitNow QR allows interoperability between all participating Banks and e-Wallets.

Through DuitNow QR, consumers can make payment from any participating Banks or e-Wallets mobile apps. Merchants would only need to display one QR Code, thus lessening confusion amongst consumers.

It is absolutely FREE for consumers.

The DuitNow QR will be displayed at merchant's payment counters.

No registration is required. All you need to have is a participating Bank's Mobile Banking app or e-Wallet app to scan the DuitNow QR to pay.

Consumer may pay up to RM 50,000 per transaction. Businesses may pay up to RM 10,000,000 per transaction at banks. The limit vary depending on your bank. eMoney providers will have lower limits.

Dispute or Request for Refund

You may contact Merchant to initiate a dispute. If you are unable to reach a satisfactory resolution with the Merchant, you may contact your Bank or eWallet via any available channels provided by your Bank or eWallet either verbally or in writing, via Customer Careline, email etc. to raise a dispute or request for a refund.

No, your bank or eWallet will be the single point of contact of your claim until it is resolved to your satisfaction.

For your Bank or eWallet to effectively investigate and resolve your claim, you are recommended to contact your Bank or eWallet within sixty (60) calendar days from the date of the DuitNow QR payment was made.

Generally, you are required to provide details of the DuitNow QR payment made such as date, time, amount and receipt or reference number of the payment. Additionally, you may also be asked to provide details of the Merchant such as store name, location, reason for the dispute or request for refund and/or and any other information as deemed necessary by your Bank or eWallet to substantiate the claim.

You will receive an acknowledgement of receipt within one (1) Business Day. Your Bank or eWallet will also inform you of the resolution time frame and provide an escalation path if the issue is not resolved within the committed time.

Generally, fourteen (14) calendar days from the date of the DuitNow QR payment is allowed to resolve your claim, subject to the course of the investigation. If a longer period of time is needed, your Bank or eWallet will notify you of the next course of action.

Generally, your Bank or eWallet will return the refunded money to your existing DuitNow QR debiting account, provided the account is still valid and active.

Yes, this is due to your Bank or eWallet was only able to partially recover the disputed amount. This may happen in circumstances such as returning one damaged item from purchase of multiple items.

DuitNow QR Transaction Fees

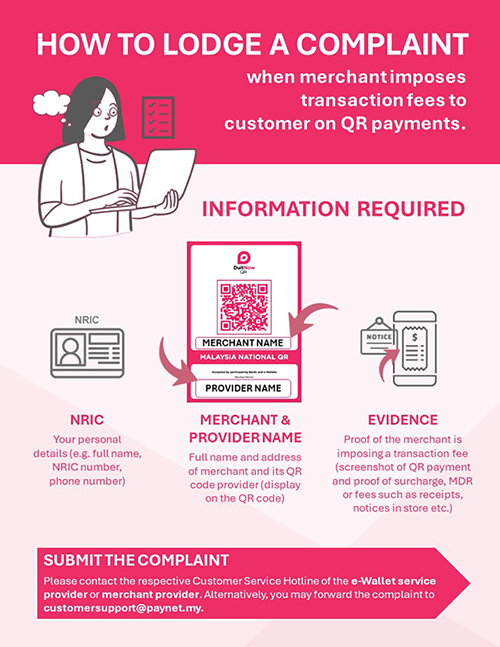

No. Transaction fees will not be charged on individual customers. Customers who encounter such a situation are advised to lodge a complaint with

- the merchant acquirer. The merchant acquirer’s company name or logo should be displayed along with the QR code at the merchant’s point-of-sale (either physical or online stores); or

- their respective e-wallet service provider (bank or non-bank issuer)

(Note: Acquirers are banks or non-bank financial service providers that onboard merchants to enable them to accept electronic payments for the sale of goods and services to their customers.)

No. Individual customers who make payments using DuitNow QR should not be paying any additional fees or charges. Products and services bought with QR payments should cost the same as paying with any other modes of payments including cash, credit cards, and debit cards.

Merchant Discount Rate, or MDR, is a common fee associated with the provision of electronic payment services.

MDR is charged on merchants, not customers. It is typically charged based on a percentage of price paid by customers to the merchant. A merchant would receive the payment made by their customers after deducting the MDR. This is similar to card-based payments that also incur MDR.

MDR is intended to cover costs that the merchant acquirers and PayNet incur to upkeep the payment systems and to maintain high service reliability and robust security standards for users.

These costs are therefore critical to ensure businesses and individuals continue to have confidence in using payment services on a daily basis.

For smaller businesses, a majority of DuitNow QR merchant acquirers announced that they will continue to waive MDR for smaller businesses. PayNet has set aside resources to reimburse acquirers that continue to offer this full waiver for micro and small merchants who uses DuitNow QR payments.